SaaS Business Valuation Guide for Angel and Venture Funds; Part 1

Defining Valuation Scope & Choosing Valuation Method(s)

“Buy for the Future, Pay for the Past”

---- Walker Deibel

“as happens in Wall Street all too often, what the wise do in the beginning, fools do in the end.”

---- Warren Buffett

Scope of Article

The scope of this article is to help provide value to a Venture or Angel fund manager with the first couple of steps on how to value their SaaS companies for a private equity exit. The scope is not to get in depth on any part of the valuation process nor when a fund manager should steer a portfolio company to a private equity exit. This is part 1 of what will be a 6-part series on SaaS private equity valuation. If you’d like more information or to subscribe to this series, sing up here; https://www.highviewequity.com/#/portal/

Quick Summary

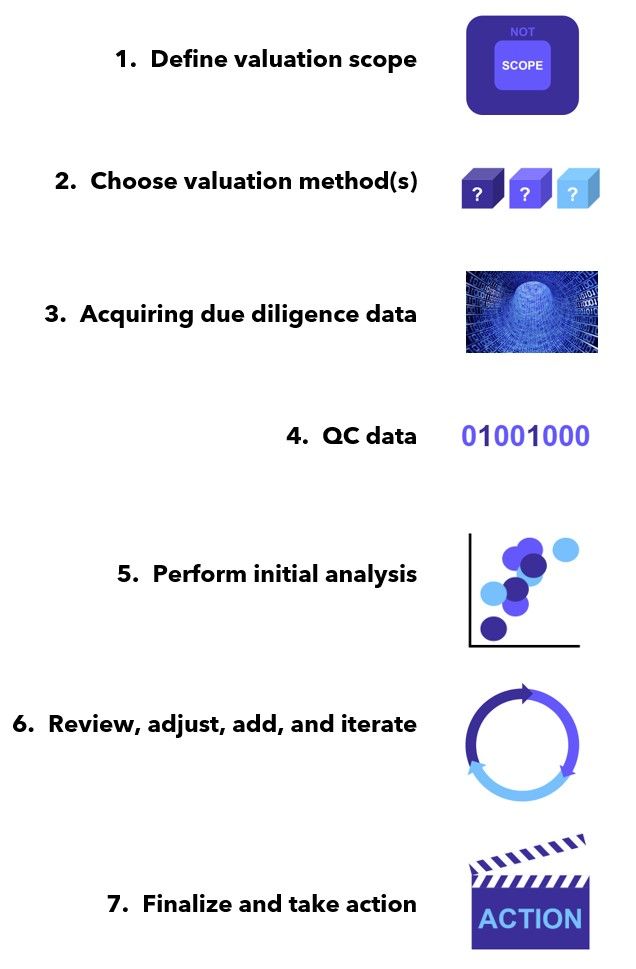

The 7 key steps to performing a SaaS company valuation are defining scope, getting data, QC the data, analyze, review, and take action. There are hundreds of methods and variations to business valuation, but we focus on the more classical multiple method. It is essential early on to define the scope of what your valuation needs to accomplish and just as important, what it does not need to accomplish.

Main Steps

There is no hard and fast rule for what the main steps are, but most discussions revolve around the actual methods as well as what the key metrics from those methods are supposed to be. Opinions range fairly widely, ranging from more established and accredited organizations such as the International Society of Business Appraisers (ISBA, https://www.certitrek.com/isba/) to niche experts such as a car wash appraiser (www.carwashadvisory.com). While variations abound, they typical involve obtaining data and analyzing based on a method. There are 7 key steps to doing a SaaS company valuation which are;

Regardless of the scope or method you chose, the key 7 steps are a constant in the process. Some steps may be skipped at the risk of yielding a meaningful result while other steps may only take a matter of seconds to do (i.e. a five figure valuation where the seller/seller broker have prepared a well done data room).

Defining valuation scope

Valuation scope is essential to ensuring that the desired product meets key needs in an efficient and thoughtful manner. It is a common error for the valuation process to skip properly defining the scope properly and early on. The scope can vary from a simplistic “back of the envelope” on a six-figure business to a full-blown offer on an eight-figure company. The size (ex. $10M or $10MM EBITDA), market sector (ex. Construction or Financial Technology), geographic location (ex. San Jose vs Boise), on or off market among other things also have a key impact on valuation and need to be understood during the scoping of the valuation process.

It is not appropriate to invest the same amount of time and capital to valuing a $100M coffee shop in a tier III Non-MSA (Non-Metropolitan Statistical Area) as it is a $25MM health care company based in a tier I MSA. This is not only for the more conspicuous difference in geography and industry, but for the less obvious (but equally or more important) fact that the risk/return on time and capital will not be justified as much for the coffee shop as the health care company. In other words, it is undoubtedly worth the $10-30M to work with a health care specialized attorney to draft the SPA (Stock Purchase Agreement) for a $25MM buy, but hardly worth it for the $100M valued coffee shop.

To ensure all areas are covered broadly, but not in depth, the scope for this article will be to value an on-market apartment property management software (i.e., Software as a Service, SaaS) business with $200M per year in gross revenue, $100M per year in EBITDA and located in Denver.

Valuation methods

At the time of this writing, google produced a result of over 95MM searching for “business valuation book”. Thomas Smale has put together a great summary specifically for SaaS companies over at FE International (https://feinternational.com/blog/saas-metrics-value-saas-business/#otherfactors). To put it simply there are literally thousands of books written on the business valuation subject and resultantly dozens of different valuation methods that yield hundreds of variations and naming conventions. To help highlight the range of these I am going to list some of (but not at all exhaustive) methods out there. Sales & Listing comparables (https://www.bvresources.com/products/deal-and-market-data) is when you take similar companies (same market sector, size, etc.) and use the statistics (average, median, etc.) to value a company. Asset Based, aka Balance Sheet Based primarily takes the value of the tangible and intangible components of a company. Income, aka as the Capitalization Method is based on a percentage return of cashflows based on the capital invested (https://www.amazon.com/Complete-Guide-Buying-Business/dp/1413312675). Multiple aka cashflow multiple or Industry Rules of thumb is multiplying an annual cashflow metric (typically EBITDA or NOI) by a commonly accepted numerical value adjusted to market sector and cashflow size. Discounted cashflows, aka Net Present Value (NPV) is taking all future projected cashflows and discounting them back to present time. What few do not know is when future cashflows are modeled to remain constant the capitalization method (typically used in real estate) is the inverse of the multiple method (typically used in business). Goodwill ratings is the quantification of the material qualitative aspects of a company. IRS Method combines goodwill and EBITDA multiples methods. Replacement cost replaces existing asset(s) with current material/labor costs starting from scratch. Appraisal typically combines multiple methods both listed here and not to arrive at an “average of averages” value. Market Price is typically reserved for publicly traded companies where the value is based on stock price and outstanding shares.

As you can see from just a sample of methods and their names, entire books can be written on the methods alone. Keeping to the scope of this article in relating to SaaS business private equity valuation we are choosing the multiple method. Keep in mind pending your scope, you very likely will want to apply at least 2-3 methods to triangulate on an average value. Given there is as much “art” to valuation as it is science, getting multiple answers that point to the same narrow value range is one of the few uncertainty mechanisms. To put this differently, just like the ubiquitous saying “if it walks, talks and acts like a duck, it’s a duck”, if three separate valuation methods drawing from the same raw data indicate a value range of $1.4MM to 1.6MM, then the company is likely worth it.

Part 2

In concluding Part 1, we hope this was informative and either brought new information to light or reminded you of key terms and/or concepts that were not at the forefront of your mind. Up next will be discussing defining and acquiring due diligence data and begin to QC it. Performing quality control on due diligence data as well as then performing initial analysis.

Sources

· Cunningham, Lawrence A.; Buffett, Warren E.. The Essays of Warren Buffett: Lessons for Corporate America, Fourth Edition (p. 16). The Cunningham Group & Carolina Academic Press.

· Martinka, John. Buying a Business That Makes You Rich . Book Publishers Network.

· Steingold, Fred S.. Complete Guide to Buying a Business, The . NOLO.

· Deibel, Walker. Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game (p. 135). Lioncrest Publishing.