About HighView Equity

As angel investors, Karl and Josh saw many firms portfolio companies in the following state:

+ Not Growing quickly enough to continue raising capital from VC

+ Not profitable enough to achieve a private equity exit

+ Not enough assets for traditional lending

They saw an opportunity to facilitate the transition from venture limbo to private equity success.

HighView partners with angel groups and venture capital firms to source portfolio companies that, while not destined for unicorn status, have created significant value in terms of intellectual property, technology, team, and brand recognition.

Specifically seeking investors who are interested in participating in a private equity exit for the portfolio company without investing additional time or money.

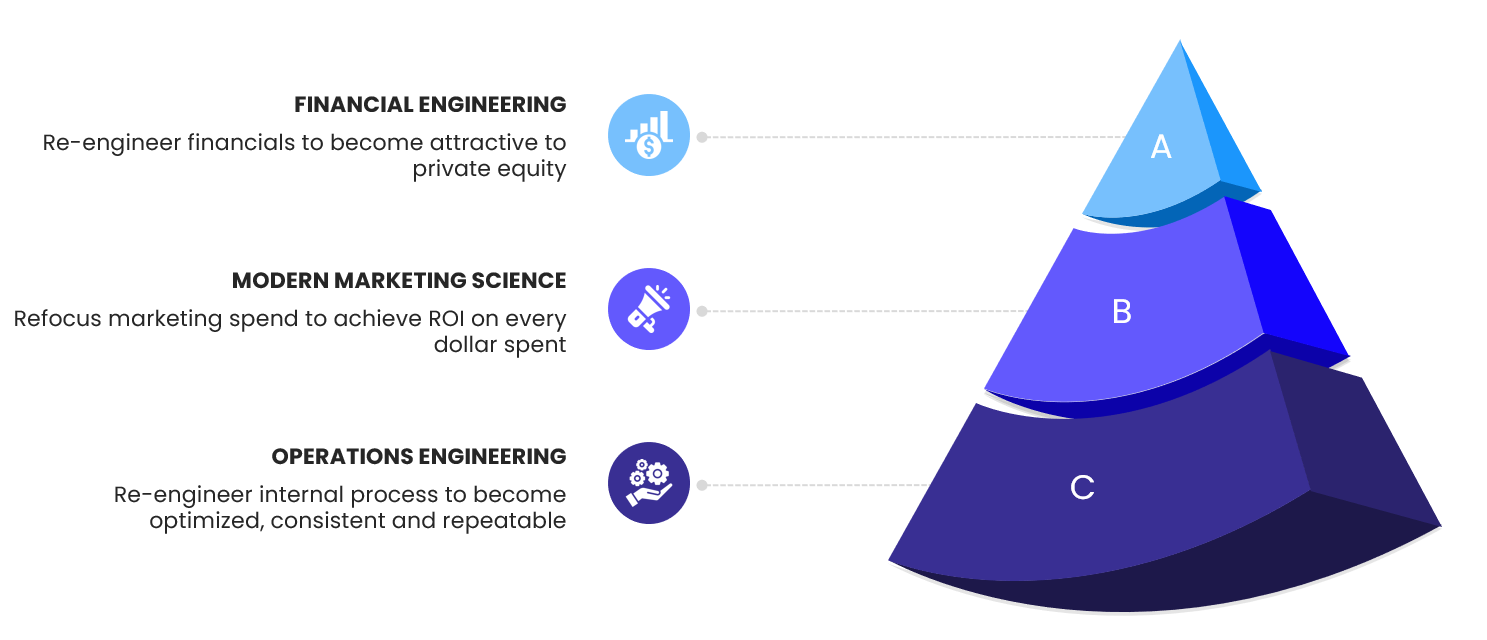

HighView Equity creates value by specializing in three key areas being;

1) Financial Engineering: re-engineer financials to become attractive to private equity

2) Operations Engineering: Re-engineer internal process to become optimized, consistent and repeatable

3) Modern Marketing Science: Refocus marketing spend to achieve ROI on every dollar spent

We execute these three core strengths to change strategy from high-growth venture startup to going concern that is desirable for upstream private equity acquirers.

Ideal venture and angel capital partners are:

- 2-10 FTE investor groups

- Investing $500k-$1MM per portfolio company

- Managing 5-20 portfolio companies

- Participating in governance for their portfolio companies

- Located in: Austin; Seattle; Denver; Portland; Raleigh-Durham; San Diego; Los Angeles

Ideal portfolio companies are:

- Engaged in a software business in the Finance, Real Estate, or Energy industries

- Utilizing a SaaS or other recurring revenue business model

- Generating $2MM-$10MM in revenue

- Have a 6+ month runway with current financing

- Challenged to meet growth targets for LPs, GPs, and Management